The data science team went to work researching ways we could do this and tested a few different methodologies. We have lots of input data from our own and public sources to feed any model we wanted to test, which worked well for us. With that said, we had low expectations about finding a predictive model that produced anything reliable.

Testing different algorithms is always our approach. For the semi-technical readers, before settling on Temporal Fusion Transformer (TFT), the algorithms we tested included ARIMA, VAR, GARCH, ARCH models (univariate), Prophet, NHits, and Nbeats. TFT is an attention-based deep learning neural network algorithm. Using a mix of inputs, it produces a forecast over multiple periods in a future time horizon that you can determine. You can predict days, weeks, months quarters (really any interval is possible) into the future. Your choice.

The picture below shows the concept of how TFT works.

Source: Bryan Lim, Sercan Ö. Arık, Nicolas Loeff, Tomas Pfister. “Temporal Fusion Transformers for interpretable multi-horizon time series forecasting.” International Journal of Forecasting. Volume 37, Issue 4, October–December 2021, Pages 1748-1764.

A continuous improvement process best describes how we developed and continue to refine the model. It’s a never ending process of improvement, as a true crystal ball is never achieved.

These are the four stages of development we went through after choosing TFT as our algorithm:

- Stage 1a: Selecting all logical observed inputs and test how they drive the model. We started with over 100 and the final model only used 20. Go to Stage 1b as needed.

- Stage 1b: Refining the time intervals of the observed inputs. Since the inputs might come in varying time intervals (daily, weekly, monthly and quarterly, etc…), we needed to find methods to standardize them. You should choose an interval that matches the decision-making forecast you are producing, if you can. Go back to Stage 1a as needed.

- Stage 2: Model iteration and improvement. Complete back testing. Examine early predictions. Go back to Stages 1a and 1b as needed. At this point, you have probably settled on one or two of the most promising algorithms.

- Stage 3: Begin using in production and comparing predictions to the future periods as they unfold. Learn and refine by going back to any previous stage as needed.

- Stage 4. Continuous improvement loop. Write long-term road map. Test new inputs as they are presented. Continuous scrutiny of the predictions against what actually happens – learn and make changes by going back to any previous stage as needed.

Note that at any of the stages of development, you can use a TFT encoder decoder to measure the importance of different inputs in the algorithm to learn which ones have the most impact on your prediction.

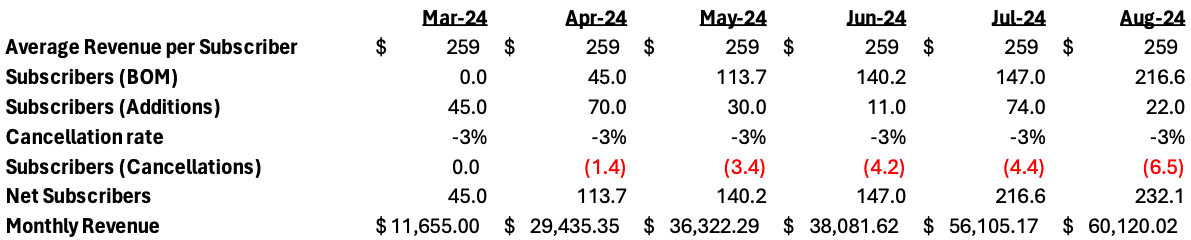

Below are the results of our model. The orange line is the actual result of the key driver and the blue line is the prediction of the key driver that was made 8 periods ago. The area to the right without the orange line is the next 8-period forecast. So, at Period 19, we can use the blue line forecast to take action based on what Periods 20-27 tell us. When we reach Period 20, we evaluate the updated forecast and we make a decisions accordingly for the future periods. This way, we have a rolling 8-period prediction/decision cycle.

As you can see the model has been refined to a level that it makes useful predictions and handles volatility of the prediction with some reliability. Right now, we don’t use this to predict the future down to the exact number, which would be ideal, but we use it for a directional understanding of where things are headed so we can make better decisions at the current decision point.