A recent analysis sheds light on the intriguing interplay between burgeoning consumer cash reserves and the surprising surge in credit card delinquencies. Despite the Federal Reserve’s reports revealing a remarkable 2.5x increase in cash holdings for the bottom 50% of households, a deeper dive into Transunion’s credit data exposes an unexpected trend in delinquency rates among recently issued credit cards.

Visualizing the Cash Peak:

Illustrating the ascent and descent of consumer cash, a Federal Reserve chart showcases the savings rate versus currency and checkable deposits for the top 50% of U.S. households. Notably, cash holdings peaked in September 2022, and while a decline is underway, the rate of decrease suggests a prolonged period before reaching pre-COVID levels.

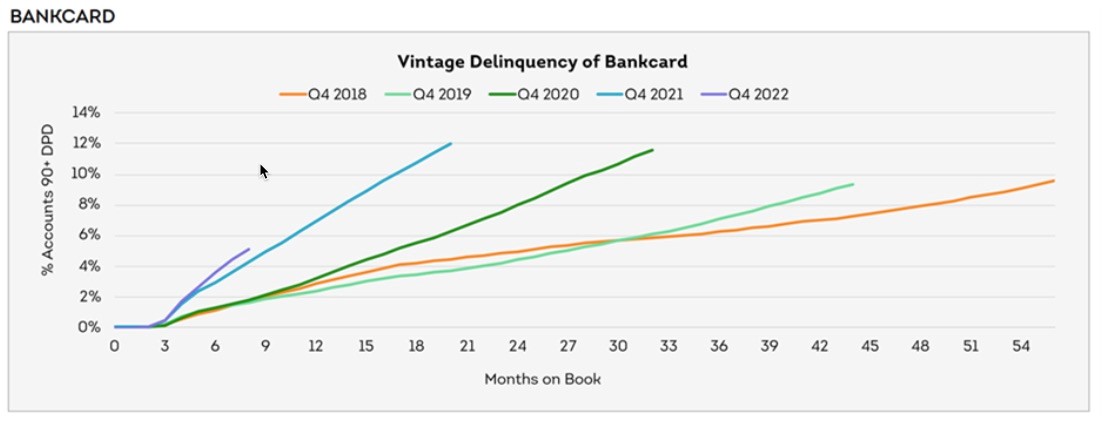

Delving into Credit Card Delinquencies:

Contrary to expectations, Transunion’s October 2023 report unravels a concerning pattern in credit card delinquencies, particularly among recent issuances. The analysis, organized by vintage (issuance date), indicates a noteworthy acceleration in delinquency rates over shorter periods. Notably, the most recent vintage (Q4 2022) surpasses the pace of all its predecessors.

Savings Rate vs. Currency and Checkable Deposits Top 50% of US Households. Source: Federal Reserve, 2023

Analyzing the Discrepancy:

The conundrum arises – why are credit cards experiencing escalating delinquencies despite consumers holding substantial cash reserves? Several factors contribute to this apparent paradox. The Federal Reserve’s data, reflecting the bottom 50% of households, conceals the nuanced distribution of cash by wealth. A deeper dive into Transunion’s data suggests that stratifying credit risk tiers may unveil higher and faster delinquency rates among lower-grade credit consumers.

Unwinding Positive Effects of COVID Economics:

The favorable effects of COVID-related economic stimuli, such as increased wages, stimulus packages, newfound credit availability, and savings from stay-at-home orders, are now unwinding for lower credit tiers. This segment had the opportunity to spend more and accumulate debt during the pandemic, with banks readily extending new credit accounts. However, as the economy reverts to normalcy, these consumers face regular demands on their cash, leading to a resurgence of credit card bills with historically high-interest rates. Consequently, the combination of heightened financial commitments and mounting credit card debt is fueling a surge in delinquencies, despite the apparent abundance of cash.

In unraveling this financial paradox, it becomes evident that the intricate dynamics of consumer behavior and economic shifts necessitate a comprehensive understanding for stakeholders in the financial landscape.

Reference: https://shorturl.at/puDY7

No comments:

Post a Comment