The stock market took some swings last week. It was down hard on January 31st on fears of no rate relief from the Fed and then rebounded firmly the very next day. An emotional roller coaster for many, to be sure. In this post, I am going to look at the upcoming rate environment but focus in on consumer debt and the potential savings consumers will experience as rates decline.

While the stock market will fluctuate wildly based on changing sentiments about interest rates over the course of 2024, consumer borrowers will be affected in a direct and consistent way because most consumer debt products are pegged to the Fed Funds rate. I am not going to focus on mortgages because much of the consumer housing market is carrying historically low rates into this environment already. As a result, decreasing rates will benefit new borrowers, not those who closed or refinanced their mortgages before 2022, which represents most mortgage holders in the US. Instead, I want to focus on total consumer debt and the fluctuating interest rates in credit cards which have rates priced as a function of the Prime Rate, which is a function of the Fed Funds rate.

The Fed has pointed to as many as three rate cuts of 25 basis points each. With the Fed Funds rate at 5.5%, this would bring down the rate to 4.75% at some point during 2024. The CME’s (Chicago Mercantile Exchange’s) Fedwatch indicator points to six cuts of 25 basis points during 2024 – 1.5% in total. This would bring the rate down to 4%. Bookending the two estimates, the Fed Funds rate will end up somewhere between 4% and 4.75% barring any unforeseen events that could change that.

Where the Fed ends up, will depend partially on the strong wage growth due to the low unemployment rate which is currently 3.7%, putting it below 4.0% for 23 months in a row. Because unemployment has been sustainably low, wages have benefited and real disposable income on a per capita basis has increased 3.7% year-over-year, which is much, much higher than the 1.7% averaged before the previous nine recessions since 1959. With that said, inflation has come into a more manageable range for the Fed, so the strength of the consumer, in my view, is less likely to cause inflation to rebound and is more important in avoiding a recession.

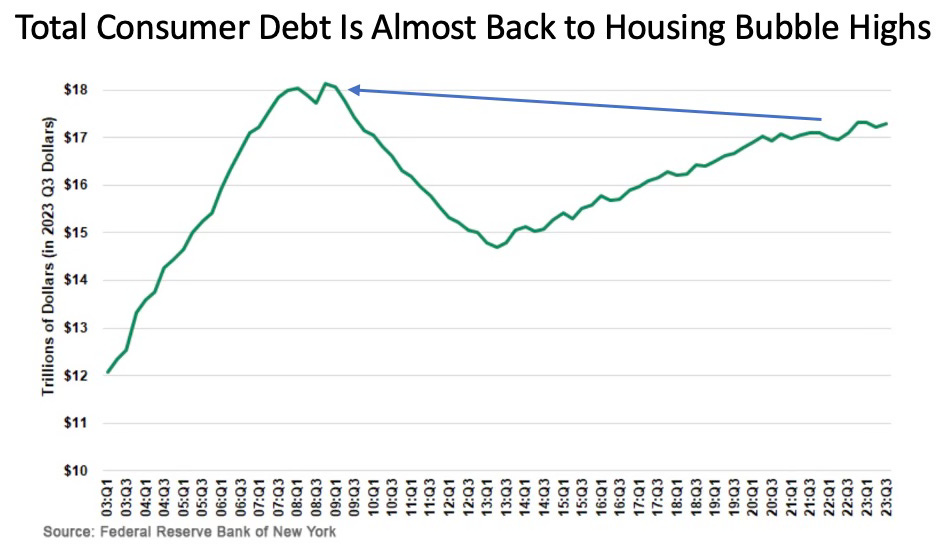

Now, with respect to consumer disposable income, interest expense has taken a some of the positive gains in wages. The chart below shows how total consumer debt has grown through Q3 of 2023. Total consumer debt in the United States is approaching levels not seen since the housing bubble highs before the 2008 crisis.

However, debt service remains well below the highs. This was caused by the massive deleveraging after 2008, where many debts carried high interest rates, and then re-leveraging into a low-rate environment that was sustained by the housing recession and then by the COVID actions taken by the Fed. So overall consumers have borrowed consistently since 2013 at very low rates, which fuels their ability to spend. You can see in the chart below, that during COVID (the absolute bottom of the line chart) debt service reached an impressive low point but even with the rebound in interest payments caused by all the recent Fed increases, debt service payments are still at a relative low point. In fact, debt service as a percentage of disposable income as of the middle of 2023 was lower than any time since 1981, excluding the pandemic period.

While the information above is about 3-9 months old (the Fed is slow with its data), the charts probably have not moved materially since they were published, in my opinion. So, taken at face value, decreasing interest rates in 2024, will significantly help the consumer.

Right now, US consumers are at near all-time lows in debt service with the highest interest rates highs that they have seen in 17 years. However, US consumers are reaching their highest accumulated debt in 17 years. Thanks to historically low rates, the US consumers have locked in super low mortgage rates, which are predominantly fixed rates and has allowed these seemingly contradictory facts to co-exist.

Back to

credit cards. The variable debts US consumers hold in credit cards are

what will drive interest expense fluctuations, and much of the increases

in debt service are related to rising credit card interest rates. In

fact, since the Fed started raising interest rates, credit card average

interest rates have risen from 15% to 21.5%. This trend will reverse

with the Fed rate cuts and US consumers will feel less payment pressure

on credit cards. We can see credit card interest rates reverse to below

20% in the foreseeable future – still high but providing immediate

savings to consumers.

I estimate that the savings

in interest they might experience should range between $100 to $200 per

household per year. This can continue to grow if rates decline further

in the future. $100-$200 per household per year may not sound like a

lot. But if you put in the context of spending events, it becomes more

meaningful. For example, it’s a few extra dinners out for the average

American household that they previously couldn’t afford.

Reference: https://shorturl.at/uADX4

No comments:

Post a Comment